The green-eyed monster

Of all the deadly sins I am guilty of, envy isn't one of them.

I have always thought of envy as being a rather daft emotion.

Why? Because unlike say anger, sadness or fear it is the easiest to control.

Now before everyone starts accusing me of being an emotionless control freak compare if you will having emotions to driving a car.

Similar to selecting the best gear to navigate the driving conditions in front of you, suppose for any given situation that it was possible to calmly select the most appropriate emotional response. Now hold that thought. With all the responses at your disposal do you think you would positively select envy?

Why? What good would it do you? How would envy help you to get anywhere or achieve anything?

It would be the equivalent of choosing a gear on your car that neither propels you forward nor reverses you back. It would be worse than neutral. It would be some new setting that makes the car vibrate whenever a newer model speeds by, and that's just pointless.

"Envy is the most stupid of vices, for there is no single advantage to be gained from it".

[Honore de Balzac]

If I envy someone their lifestyle, talent or the fact that their start-up has just IPO'd for squillions, my first thought is typically 'good on them'. Who knows what else is going on in their life, what obstacles they have overcome or what life choices they have made or might yet make. Serendipity is a fact of life.

So when I imagine being envious, what is it I am being envious of?

The obvious answer is: "I want what they have."

More likely the answer is: "I don't like what I have."

Envy is all about comparisons. What have you got that I don't have?

But if you truly want to understand envy, it is more enlightening to examine the 'why' not the 'what'.

In the Art of Thinking Clearly, Rolf Dobelli writes:

"Like all emotions, envy has its origins in our evolutionary past. If the hominid from the cave next door took a bigger share of the mammoth, it meant less for the loser."

Quite simply envy kept us alive thousands of years ago. If you were too relaxed about hunting and gathering you probably didn't survive.

Evidently my genetic ancestors were an envious bunch but equally there is no longer an evolutionary requirement to be envious. If my mate buys a flash car he isn't depriving me of anything, I am not losing out. All I can think to say is "good for you."

Does this mean we should consign envy to the genetic and emotional scrapheap?

Yes, envy is a pointless emotion.

No, if you are management negotiating equity terms, it might just pay to be a bit more envious.

Envy ratio

When negotiating management equity terms with investors there needs to be a fair allocation of risk and reward between the investors and the management team.

Invariably the financial and personal commitment that management make is disproportionately greater than investors - management could quite literally lose their shirt. Investors? Less so.

And because management's risk is greater this implies that their investment return should be greater.

How then to assess the relative positions of management versus investors?

This is where the envy ratio helps.

Envy Ratio - Definition, Importance, and How to Calculate (corporatefinanceinstitute.com)

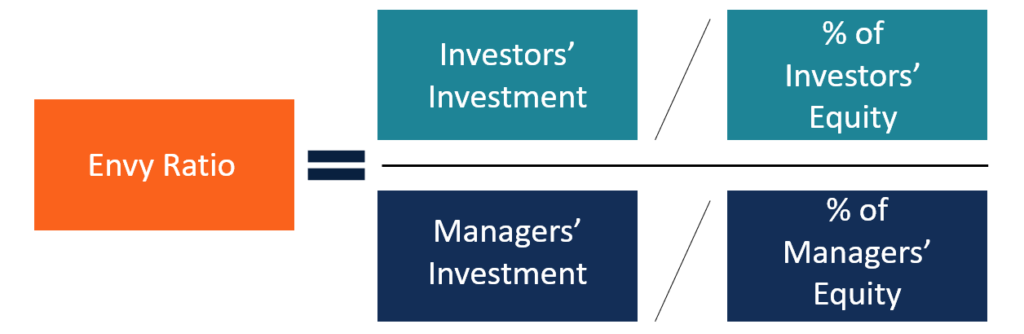

The envy ratio is essentially the equity price paid by management versus the equity price paid by investors.

It indicates how much management spent to acquire their equity, relative to what investors spent to acquire theirs and so helps management determine the attractiveness of a deal or even compare the terms of one deal to another.

A low ratio (perhaps below 5) implies that management are under-incentivised (the risk / reward return is low); a high ratio (perhaps 8 and above) suggests an attractive deal for management.

Is greed good?

As well as being a tool to measure the relative attractiveness of a potential investment, the envy ratio is also a reminder for management not to get too greedy.

A high envy ratio may seem a no brainer but if investors start to perceive that management are being too richly rewarded they (investors) have a funny habit of redressing the balance by making their own instruments more expensive.

And as I continually preach to clients; what is important is not what you get, but what you get to keep.

Equity in the hands of management might not amount to much if instruments held by investors need to be satisfied in priority to management receiving any value.

So on those rare occasions when it pays to be envious, don't let greed spoil it.

unknownx500

unknownx500